Transaction Management

The Transactions section provides comprehensive visibility into all payment activity across your Devdraft account. Monitor payment status, investigate issues, and track your business performance in real-time.

Transaction Overview

The Transactions dashboard gives you a complete view of your payment activity:- Payment History: All transactions organized by status and date

- Real-time Updates: Live status updates as payments process

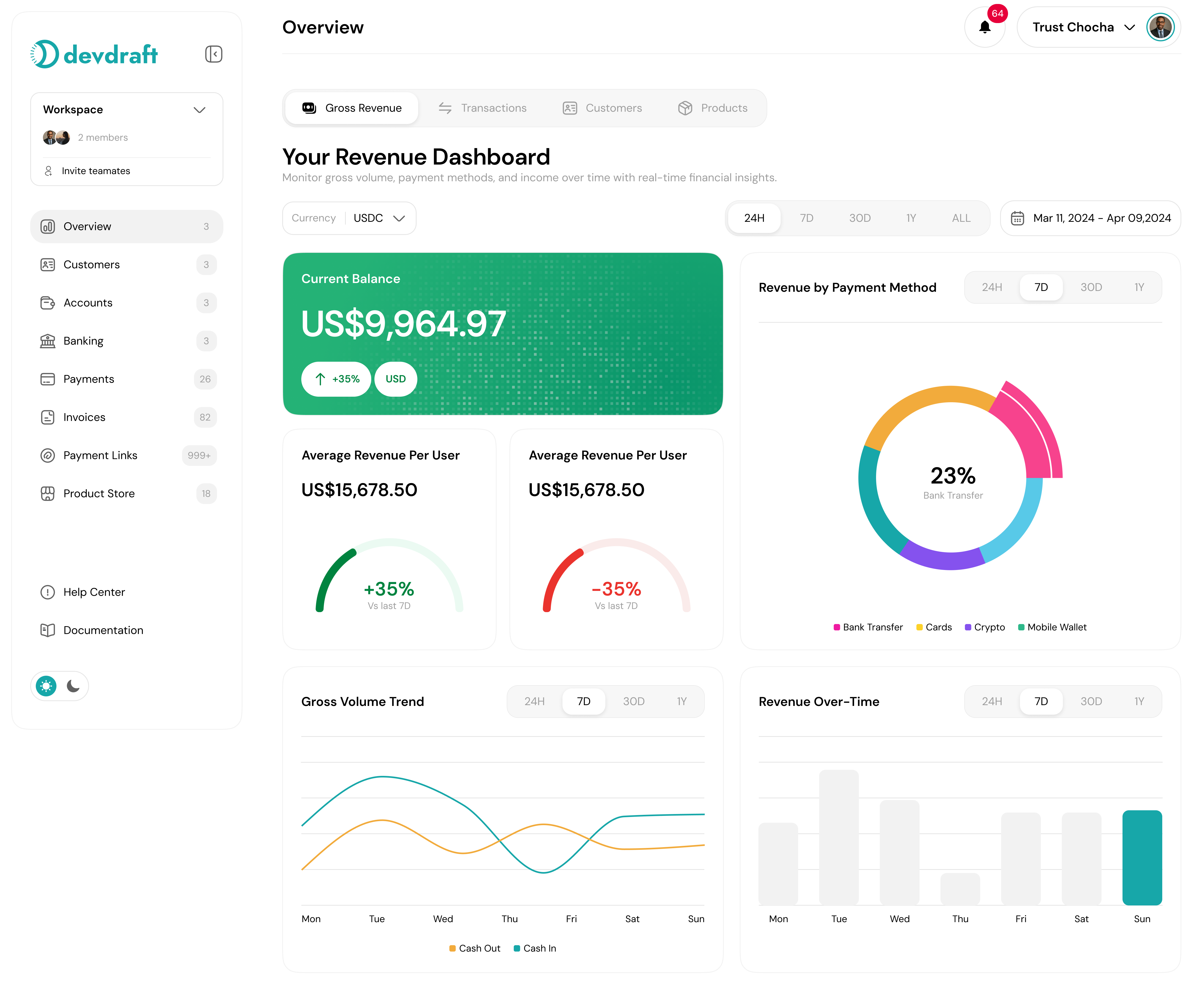

- Detailed Analytics: Revenue trends, payment method distribution, and conversion rates

- Search & Filter: Find specific transactions quickly

The Transactions dashboard shows all payment activity with filtering and search capabilities

Viewing Transaction History

Access Transactions

Understand Transaction Status

- Pending: Payment initiated but not yet confirmed

- Processing: Payment is being processed by the payment provider

- Completed: Payment successfully processed

- Failed: Payment was declined or encountered an error

- Refunded: Payment was returned to the customer

- Cancelled: Payment was cancelled before processing

Review Key Information

- Transaction ID and date

- Customer information

- Payment amount and currency

- Payment method used

- Current status

- Associated product or service

Transaction Details Page

Click on any transaction to view comprehensive details:Basic Information

Transaction Details

- Transaction ID: Unique identifier for the transaction

- Date & Time: When the transaction was initiated and completed

- Amount: Total amount charged (including fees)

- Currency: Payment currency

- Status: Current transaction status

- Payment Method: How the customer paid

Customer Information

Payment Processing Details

Detailed transaction view showing customer info, payment details, and processing logs

Filters and Search

Efficiently find the transactions you need with powerful filtering and search capabilities:Search Options

Use Search Bar

Apply Status Filters

- All transactions

- Pending payments

- Successful payments

- Failed payments

- Refunded payments

Filter by Date Range

- Today

- Last 7 days

- Last 30 days

- This month

- Custom range

Filter by Payment Method

- Credit/Debit cards

- Bank transfers

- Digital wallets

- Cryptocurrency

Advanced Filters

Advanced Filtering Options

- Amount Range: Filter by transaction amount

- Currency: View transactions in specific currencies

- Product: Filter by specific products or categories

- Customer: Search by customer name or email

- Location: Filter by customer’s geographic location

- Device: Filter by device type (mobile/desktop)

Transaction Analytics

Monitor your payment performance with comprehensive analytics:Key Metrics

Revenue Metrics

- Total revenue

- Average transaction value

- Revenue growth rate

- Monthly recurring revenue (MRR)

Transaction Metrics

- Total transactions

- Success rate

- Processing time

- Chargeback rate

Performance Reports

Access Analytics

Select Metrics

- Revenue trends

- Payment method distribution

- Geographic performance

- Customer acquisition

Set Time Period

Export Data

Transaction analytics dashboard showing revenue trends and payment method distribution

Error Investigation

When transactions fail, use the detailed error logs to diagnose issues:Common Error Types

Payment Declined

Payment Declined

- Insufficient funds

- Expired card

- Incorrect CVV

- Card restrictions

- Fraud detection

Processing Errors

Processing Errors

- Network timeouts

- Processor unavailable

- Invalid payment data

- Currency conversion issues

Customer Issues

Customer Issues

- Invalid email address

- Missing required fields

- Address verification failed

- Age restrictions

Debugging Failed Transactions

Review Error Details

Examine Customer Data

Check Payment Method

Review Processing Logs

Refunds and Disputes

Handle customer refunds and payment disputes efficiently:Processing Refunds

Locate Transaction

Initiate Refund

- Full refund

- Partial refund

- Custom amount

Add Refund Reason

- Customer request

- Duplicate charge

- Product not received

- Quality issue

- Other

Process Refund

Handling Disputes

Monitor Disputes

Gather Evidence

- Transaction receipts

- Customer communication

- Delivery confirmations

- Product descriptions

Respond Promptly

Track Resolution

Best Practices

Transaction Management Best Practices

- Monitor transactions daily for unusual activity

- Set up alerts for failed payments and disputes

- Keep detailed records of customer communications

- Respond quickly to customer inquiries about charges

- Regularly review and update your refund policies

- Use analytics to identify payment optimization opportunities

- Maintain clear documentation for dispute resolution